Everyone that is involved in Forex Trading for awhile would have all heard these 3 misconceptions about Forex Trading, but beginner traders continue to fall for them. These are also some of the reasons why many Forex Traders end up going broke.

So how can we avoid these common traps and make money from Forex Trading?

Firstly lets look at the 3 areas to avoid when you are starting out Forex Trading.

Making Regular income and Profit:

This is misconception number 1.

Think about this for a moment how can you make regular income from something that changes as frequently as the Forex Market. No matter how great the system is the market simple changes all of the time, how often have you been in a well trending trade only to see something strange occur and a nice profit turns to a break even or worse a loss? So the next time you see or hear of someone saying make x% profit every month's run!

Ability to Predict Forex Prices in Advance

This is misconception number 2.

This is the biggest crowd puller, think about it can you see into the future? No. No matter how great the theory, how well it has been back tested you still cannot have a theory that works 100% of the time. Think about it if there was a theory that worked 100% of time we could predict future results. So the theory would need to take into account, all interest rates cuts and rises, speeches from the banks and monetary authorities as you can see highly unlikely. No Impossible.

Make Massive Profits minimal Exposure:

This is misconception number 3.

Many of us would have seen systems advertising the make 100% gains and have less than 1% drawdown. This is not reality and you can see the real results to support this outrageous growth rate to drawdown that has been audited.

So consider this and Improve your chances!

The common fact to trading is that over 95% of all traders will lose their money and the ones that do believe at least one of the above

So how you can become successful as a forex trader is understand that you can make profits in the long term, that making money is going to be up and down and that Forex trading is a game of odds not certainties. They also understand that to make money you need to take risks, the old saying of risk versus reward.

If you want to get involved in Forex trading and win you can, by getting a good solid Forex education and good Forex mentoring. In some cases you can find a Best Forex Brokerthat can assist you. If you are looking for a great Forex Broker, look at the CFD FX Report they have recently researched all the Forex Brokers and have come back with who they believe to be the best.

You can win and enjoy huge rewards for your effort, if you understand the challenge of Forex trading and what the reality really is.

Regular Income From FOREX

Posted by satyam at 3:29 AM 0 comments

Labels: Foreign exchange market, Forex, Forex Broker, Forex Market, Forex Trading, Investing

The Trend of Forex Trading

Forex trading system of the world performs trade of about $2 trillion each day. The enormity of the gigantic financial capacity of the Forex trade can be truly grasped if you compare this mammoth amount to the $25 billion that New York Stock Exchange trader's trade per day.

The quintessential qualities of a Forex trader are discipline and endeavor. If you are diligent and logical in studying the Forex market trends then it wouldn't take you much time to hit the jackpot in Forex trade. However, if you cannot manually manage to analyze all the currency trends yourself then you might take the help of a automatic signal service or a Forex trading software which would send you alerts and signals about buying and selling currency after elaborate research and analysis.

If you use one of the automated Forex tools available in the market then you would be able to evaluate the trends of exchange rates and Forex market conditions within a few minutes with the help of the data provided by your FX software. As a result you will be able to close your forex deal in less than an hour. Thus an automated Forex tool would ensure that you are making optimum use of your trading time.

The global Forex trading market is only merely remarkable because of the huge volume of monetary transactions that happens through it but it is also a commendable phenomenon due to its geographical dispersion. With the help of automated FX software you can trade in various local as well as international Forex markets within different time zones without personally monitoring those various markets day in and day out.

However, before you decide to buy particular FX software, you need to put in a little effort to search for a Forex tool which is easy to use and is ideal for beginners. Glean information about that particular Forex tool which you plan to buy and thoroughly read the testimonials for that particular Forex trading software before you purchase it.

Posted by satyam at 3:26 AM 0 comments

Labels: Business, Foreign exchange market, Forex, invest, Trade

Forex Trading Errors

When we are trading we will all from time to time make a mistake when forex trading and it is normal and sometimes can be looked upon as healthy, so as to know that the decisions will either make or break you. However, if this becomes severe to a point wherein you lose more than you can afford to, then you would have to take measures in order to avoid further damage. This is why when you are trading you must make sure that you only trade within your limits. If you can't afford to lose it, don't trade.

When trading you must make sure that you keep your emotions in tact, do not let them take over. If you let your emotions take over the result is more than likely to cause even more rash decisions and can cloud your strategies, producing even more disastrous results. You should aim for more positive months with good turnovers but face it; there are some periods wherein gain is not achievable.

Before trading you should make sure that you have a plan and part of that plan is to employ a money management technique; in case is where you went wrong the first time. You should always consider what your losses are going to be. Since most traders would tend to gamble as opposed to trade, instead of making a calculated risk, their bank accounts would be drained each time there is a loss. They don’t have a great capital management system which causes damaging effects.

You must make sure that you educate yourself as much as possible about the Forex Market, a great place for education lessons is the CFD FX REPORT They specialize in offering free Forex Education as well as helping you find the Best Forex Broker.

Each trader has their own attitude towards forex trading and what risks they are personally prepared to take, but learning about the inherent principles can go a long way in helping you develop your own style and making you more successful in the long run. You can also develop a trading system and make sure to be disciplined enough to follow what you have created. Remember create the plan, plan the trade and trade the plan. You should have this next to your trading screen at all times and never forget it.

Do not associate loss with the feeling of being a loser, in order to be a successful trader you will take losses and the best traders can handle them. When trading you should know that you can't pick the market 100% of the time, so there is going to be losses it is how you handle those losses to how successful you are. The forex market is an objective industry wherein sound decision-making and strategies are employed and not about judging your emotional capabilities and dealing with them. If you can't handles losses, or losing money, do yourself a favor and don't trade.

Posted by satyam at 3:23 AM 0 comments

Labels: Foreign exchange market, Forex, Investing, Money, Trade

7 Traits Of the Great Forex Trader

To be a successful Forex Trader takes time, education and knowledge, but the great news is anyone can do it. You do not have to be a genius to be a Professional Forex Trader.

There will be many people that disagree with the above and end up broker, because they people have been successful in other areas and they see Forex Trading simply as a financial game. They do not put in the require effort to make themselves successful. So what are the traits to make you a Great Forex Trader?

Lets Examine these factors:

1. Do not take forex trading for granted. They see forex trading as the same if not harder than most specialized profession. They put in a lot of efforts and time to trade well.

2. They acknowledge the financial risks in forex trading. They know that they can win and as well lose money in forex trading. They use smart money management skills

3. They will educate themselves first and build up the knowledge the same as any profession, remember it all takes work. They respect and obey all the previous rules set by the previous successful traders. They understand about trend trading and why it is risky to trade against the trend.

4. They will have patience and understand that it takes time to be successful. They don't see it as a get rich quick scheme. They invest a small amount first and build up.

5. They know the importance of having a mentor like any profession. They understand their deficiencies as a beginner and are always seeking knowledge from the experienced traders.

6. They stay with one proven trading strategy and trading only one currency. They do not jump from one strategy to another. They do not try trading many currencies at one time.

They are devoted to understanding the nature of them and maximizing their profits while minimizing their risks.

7. They set aside sufficient capital that they can afford to lose. With money they can lose, they do not feel pressure while trading. They simply follow their trading plan on executing their trades.

The figures are that 95% of traders will end up broke, because they simply fail to plan and will not use the above traits. Make sure that you get the right level of education and knowledge and if you need more information feel free to visit the CFD FX REPORT , they have a host of free education lessons, they can help you find a Forex Broker.

Posted by satyam at 3:20 AM 0 comments

Labels: Business, Foreign exchange market, Forex, Investing, Money

Forex Trading - The top 5 Tips

We have all heard and read how much money we can make from Forex Trading, so what are the real rules and tips that will make us money from Forex Trading? Below we will uncover the real tips for Success.

Below are the 5 Tips to Help make you big money, they are not listed in order of importance.

1. Never buy a Forex Robot.

This is simple if you had a program that would make real money would you sell it? No.. You would keep it. The simple truth is most of these people are selling these programs and that is how they make the money not from Forex trading. So beware.

2. Get Educated and Learn Fast

Anyone can learn Forex trading and anyone can make money, you don't have to be a genius. You don't need to spend long doing it either and you should be able to learn everything you need to know, in a couple of weeks and then your all set to trade. You should make sure that you have a trading plan and some rules.

3. The Best Proven Systems are Simple:

Make it simple, use some indicators and support and resistance. Forget trying to be clever or complicated, simple systems are far more robust than complicated ones and work. People will more often than not try and complicate things.

4. Make sure you have Risk and Money Management Rules

Success is built on money management and risk management and you need to learn about volatility and standard deviation of price and if you have no idea what it is make it part of your essential Forex education.

5. The Golden Rule is Discipline- Set the Rules and Stick to Them

No matter how great of a trader you are you will have losses, so you need to ride them out and have discipline, which means having rules and sticking to them

Discipline comes from knowledge of what you are doing and the ability to keep your emotions under control. Holding discipline is the key to success.

Posted by satyam at 3:17 AM 0 comments

Labels: Foreign exchange market, Forex, Forex Market, Forex Trading

Trading without Indicators

When it comes to trading most professional traders will be trading with indicators, so when most people hear that someone is trading with out them there is an instant look of bewilderment. To them it sounds like driving in the dark with no lights. But in fact it is the opposite.

So to people that trade without indicators they have to same reaction to people that trade with 10 indicators on their charts in order to place a trade. They will view all of these indicators as causing a blind spot to what is actually going on in the market.

FOREX Traders have been trading without indicators for as longs as the market have been around. This is what is simply known as price action. This particular trader is looking at the chart, looking at the current prices movements, comparing it to past price action movements to predict future price movements. So in simple terms everything we need know is sitting there right before our eyes, without the block of needless indicators.

Here is an example, within the FOREX Market there are certain patters that will be repeated on a constant basis. They are predictive in nature, as opposed to indicators like and RSI or MACD which are always lagging. They are only telling us what has already happened. Anybody can be a millionaire if they only tell you what has happened already. The real skill is using past information to make an informed decision about what the future holds. Trading without indicators is as close as we'll ever get to being a FOREX Trading psychic.

For more education lessons please feel free to visit the CFD FX REPORT they are helping traders become more educated.

Posted by satyam at 3:15 AM 0 comments

Labels: Business, Foreign exchange market, Forex, Investing, Trade

Indicators In Forex Trading

Forex traders often look at indicators such as Bollinger Bands, Pivot Points, MACD, Moving Averages which help them to determine where to enter or exit trades. Using technical indicators is fine, however many traders overemphasize their importance or just plain misunderstand them.

Many Forex traders think that they can simply download an indicator and then mechanically apply it into their trading and do so profitably. This is just a plain illusion. Successful traders realize that there is a lot more to using indicators than just asking them to generate buy/sell signals or pin-point exact entry points. Technical indicators for them represent just one part of their trading strategy.

Let us take a look at some of the reasons why you should not put all your faith into those sometimes confusing little indicators.

Take Moving Averages for example. They are "supposed" to show the direction of the trend. The most common and often used are the simple 200day MA, 100day MA, 50day MA, 35day MA and the 21day MA but they are only valid on daily graphs. Some Forex day traders say that a good signal is when the 50day MA is crossed by the 13day MA and that when this occurs you should trade in the direction of the cross.

The problem with this (apart from the fact that it only works on daily graphs) is that these types of ¡°crosses¡± do not occur often enough for traders to exploit them. This can often lead to a situation where traders are seeing what they thought was a cross now reverse and uncross. Even worse, it can lead to a situation where day traders are "chasing" and trying to anticipate a cross. If you are doing this, you are distancing yourself from the market which you are trying to trade. Not only are you trying to guess what the price is going to do next but you are guessing what the indicator, based on the prices, is going to do next.

Other problems with technical indicators involve issues with the quotes and prices given to you by your broker. Forex brokers are market makers and as such different brokers will give you different quotes and prices at a specific point in time. Naturally, a different price could lead to a situation where different traders, trading the same market have the same indicators giving them different responses. Thats how arbitrary technical indicators can be.

Finally, a lot of these technical indicators were developed by people trading the stock market. With the growth of computers and software packages that incorporate these indicators, technical analysis has become very popular and spread to other markets such as the Forex market. What currency traders should be aware of however, is that as these indicators were developed in a time where real time information did not exist. As such, the limitations of technical analysis becomes even more exaggerated in Forex trading ¨C not only is technical analysis an interpretation of historical events but it becomes even more so in the Forex market, a market moved by real time events.

Posted by satyam at 3:10 AM 0 comments

Labels: Business, Foreign exchange market, Forex, Investing, Stock market, Trade

For Forex Traders

Forex trading can deal with lots of money and so when you are trading you need to be sure that you have optimal conditions. Too many traders trade out of habit and this can be a dangerous thing because it may not mean you have the best conditions. As a matter of fact trading in poor conditions can cost you hundreds and sometimes thousands of dollars. Trading conditions will not always be optimal and you cannot wait to only trade when they are. It isn't about recognizing the perfect time to trade. Instead it is about knowing when not to trade. When the market is moving sideways or not really moving at all it is unwise to trade real money. You have no indications of what is going to happen and so you are making your decisions off of pure guess and that is a dangerous place to be in. Do not trade real money when you are ill or overly tired. The condition of your body can have a big effect on how your mind thinks. If you dive into trading and you are tired, worn out or just sick it will have an effect on how quick you think and what you think. Trading when your mind is not at a high will mean trouble. Give you body the time to rest and save your bank account the funds of you trading while sick or tired. There is almost nothing worse than trading when you are emotionally distracted by other factors. It is horrible for two reasons. One your mind isn't on the trading take place, it is off trying to resolve or analyze the problem. The less focus you have the more mistakes you make. The second reason is that if you are emotionally distracted then you are already allowing your emotions to take precedence on your decisions. If you are emotionally distracted then the odds of you trading based on emotion are extremely high. And finally never trade with money you cant afford to lose or when you feel you have to make a certain amount. Those factors create unnecessary pressure on you and your trading.

Posted by satyam at 3:02 AM 0 comments

Labels: Business, Foreign exchange market, Forex, Investing, Trade

Global Forex Trading

Forex is one of the greatest homey work opportunity to make money. It gives an opportunity to make money from the comfort of your home and spending the time with family at the same time.

It is also an opportunity which you can do along with your existing day job. Forex means foreign exchange and Forex trading means is the trading between foreign exchanges.

Forex trading requires some knowledge about the way the Forex market runs. You have to learn about he factors both local and the global which affects the market.

If you want to succeed in this particular trading you must have the knowledge about the basics and facts.

Global Forex Trading offers the chance to deal in real time online currency trading that makes millions of forex brokers become more rich every day.

Global Forex Trading has less publicity that stock and commodities market and even the futures, even more than $2 trillion of currencies are transacted every day on the global forex market.

Compared to stocks and shares or commodity markets that have specific opening and ending trading times. At the same time, Forex markets are available for trading anytime with price of currencies changes and fluctuates every time.

Forex trading has become an extremely popular way to trade the global market, the largest and most liquid market in the world.

The Forex Trading market is open 24 hours a day. Forex trading also gives free commission and available on more than 60 currencies worldwide.

Global forex trading boasts that they provide the only forex trading platform that is suitable for both beginners and professionals.

Forex Trading has no restrictions of getting profits no matter what the market condition.

Nowday, the Global Forex Trading is available not only for the large investors but the smaller one can take a part too.

Leverage is the main key and powerful tool to Forex Trading wealth. You should have a good education in Forex trading to reach gain and profits consistently.

In Forex trading, you can get a leverage of 20 to 50 times commonly up to 100% margin in some special cases. In stocks or shares, you may be able to get it of 50 - 70% of your stocks or shares.

Leverage is the main key and powerful tool to Forex Trading wealth. You should have a good education in Forex trading to reach gain and profits consistently.

With that leverage comparison, you may be able become a millionaire fastest in Forex trading.

All things you need to know and learn it up in Forex trading ; knowing risk level - how much you are willing to lose, understanding the different Forex trading systems as technical and fundamental and research the trading systems which you can be familiar with how they work.

Also learning the trading trends, price history, support and resistance lines, familiar with the fundamental economic factors and its issues that effect to the Forex market.

Posted by satyam at 3:00 AM 0 comments

Labels: Business, Foreign exchange market, Forex, Forex Trading, Investing, Trade

How to Choose A FOREX Broker ?

Most investors who trade Forex stocks use a broker. A broker is an individual or a company, who buys and sells stocks according to the investor's wishes. Brokers earn money by collecting commissions or fees for their services.

You should check that a broker is registered as a Futures Commission Merchant (FCM) with the Commodity Futures Trading Commission (CFTC) as protection against fraud or abusive trade practices. A Forex broker also needs to be associated with a financial institution, such as a bank in order to provide funds for margin trading. Picking the right Forex broker for you will take some work on your part. There are brokers who charge a flat fee and some that charge commission. It may be a good idea to talk with friends and business associates about their brokers. You may get some good leads, and you're certain to hear who to stay away from. There is nothing like word of mouth advertising.

If you are thinking of investing online, you could choose several online brokers and contact their help desks. Seeing how quickly they respond to your questions could be key in how they will respond to their customers’ needs. If you don't get a speedy reply and a satisfactory answer to your question you certainly wouldn't want to trust them with your business. Just be aware that as in other types of businesses, pre sales service might be better than after sales service.

Before you choose an online broker get a copy of their online demo account. What features are included? Is the software reliable? Does it offer automatic trading? Are there extra software features that cost more?

Before setting up an account with a Forex broker you will need to do further investigation. How quickly will these brokers execute your buy/sell orders? What is their policy on slippage? What are the transaction fees? What is the spread, fixed or variable? What are the margin requirements and how are they calculated? Does the margin change with currency traded? Is it the same for mini accounts and standard accounts?

Don't forget to ask about minimum account balances and interest payments on account balances. Make sure that your funds will be insured.

For instance, many of the world's wealthiest people gained their fortunes by becoming an owner of a sucessful company, be it one they've built themselves or a company that someone else has already built and maintained sucess with. Take for instance someone like Warren Buffett owner of Berkshire Hathaway. Warren Buffett has become one of the richest men in the world by buying successful companies and keeping them under the management of Berkshire Hathaway for the long term. If you had invested just 10,000 dollars in Warren Buffet's company when he was first starting out you'd be a millionaire many times over by now.

Owning your own business is a great way to increase your wealth, along with business ownership many other wealth magnates have increased their money through the investing in real estate and the stock market. Investing the way other big players invest is a smart move as long as you understand the risk involved. If you have an understanding already about how to invest then you should be taking the necessary steps to invest wisely and diversify your portfolio.

If you have long-term financial goals, like retiring at an early age then your investment portfolio needs to grow quickly. Things like putting all of your money in the bank would likely not help you achieve your long term goals as the interest which banks pay would likely not outweigh the effects of inflation on your money.

Investing is not for everyone and may not even be necessary for some individuals. If you are the type that doesn't mind working your whole life and are happy maintaining the standard of life you're currently living then perhaps you need not jump into the investment game. You could also look for safer investments such as government backed bonds or money market funds.

In the end if you would like to start investing then you should go to your local Barnes and Noble store and pick up some sort of beginner's guide to investing.

Posted by satyam at 2:58 AM 0 comments

Labels: Business, Forex, Investing, Investment, Stock market

Be a Successful Trader

The share market today is as volatile as we have seen it, as stock prices continue to fluctuate the only way to preserve your money is to sit on the sidelines and the chaos goes on in the financials and other sectors. With the wild swings in the market as it continues at times to make no sense. We have seen days of down 500 points, followed by days of up 450 points, actual trading sessions moving as much as 1000 points. How do we make sense of these crazy markets and more importantly how do we make money.

Do not worry there is a systems out there that will teach you manage your trades. With this type of knowledge you can go from a learner trader to an Expert Trader

Forex Broker in no time.

Becoming a successful stock market trader requires learning and having a certain level of knowledge, confidence and the ability to control your fear and greed. Stock Market or Forex Trading is best explained as supply and demand, if a lot of people want the stock it goes up, if they don't want it then it falls. There are endless amounts of research available today from online reports, newspapers, education lessons the list is quiet long so how do you decide when and where to start. The first step you need to take is to decide that you want to become a trader. Then you need to right out your goals and your reasons why.

What you now need to do is to learn and understand that in theory things can seem simple however once you are trading in these at times crazy trading markets things can seem confusing. This is why it all comes back to having the right level of education and knowledge and where possible a great mentor or Broker. Using these steps almost anyone can become a trading success.

To learn more on the stock market or forex market feel free to visit the CFD FX REPORT as they have some excellent education lessons available, and they can also help you find the best online brokers in the market.

Posted by satyam at 2:54 AM 0 comments

Labels: Business, Foreign exchange market, Forex, Investing, Stock, Stock market, Trade

Successful Forex Trading

Image via Wikipedia

Image via Wikipedia

.

There are some major advantages to Forex Trading.

* The long hours that the Forex market is open, it trades 24 hours a day for 6 days per week and is the most liquid market in the world. So even if you have a full time job you can still come home and trade. It is a great way to start out, paper trade build up confidence start achieving financial success then you can leave your current job.

* It doesn't matter what the market is doing as you can just as easy go long (buy currency) or go short (sell currency) so there is never a bad time unlike buying stocks. The liquidity means that you have no problem selling.

* You don't need thousands to start. The reason that you don't need massive bank balance is because you can use leverage, in some cases you can get 400:1 so if you have $1000 you can leverage that into $400,000, which can make for great profits. Also you don't pay brokerage or commissions. If you are looking for a great Forex Broker feel free to visit us and we can show you the best Forex brokers in the markets.

* The market will never go broke. Unlike share trading where companies can collapse it is very unlikely to happen in Forex. Imagine if the USD was worth $0, so you can see very unlikely.

* If you are new to the foreign exchange market, you do not have to worry about spending thousands of dollars to learn or buy a course. There is online Forex trading course that will explain how the forex market works and a Forex tutorial will also explain about fundamental and technical strategies that are available to you as a Forex trader.

* Work your own hours if you don't feel like trading then you don't have to, it will always be open tomorrow.

Posted by satyam at 2:50 AM 0 comments

Labels: Business, Foreign exchange market, Forex, Forex Trading, Investing, Money, Trade

Forex Report - How to Be A Millionaire Trader in FOREX trading

We all want to make money from trading, and we all want to make millions from the stock market of the Forex market. However it is a well know fact that over 90% of traders will in fact go broke and not become successful. So if we are to look at who does become successful there is a group of people that tend to become more successful than others.

There is a group of individuals who tend to make the better traders and their non mathematicians or College educated, they have a skill that anyone can actually learn and their very successful. The group of individuals I am referring to are...

Professional card players who are great at playing cards and poker and the exact same skills you need in these games are the ones you need in Forex before we explain why lets dispel one of the greatest myths about Forex Trading:

One reason for this is if you watch all great card players, they will all have one common trait, which is patience. They also realize that they cannot win every hand, and as traders we cannot win every trade. If we understand this we are increasing our chances of success as a trader.

We also must realize there is more trading days to come, as there is more cards to be dealt. So if we miss a trade, don't trade for trades sake.

Remember DO NOT Trade for TRADES SAKE

Forex Trading is Complicated

To enjoy Forex trading achiever does not take you have a college education or have a complex Forex trading strategy or knowledge of maths and the reason is simple - Forex trading is simple and if you get a system to Complicated it will break in the ever changing brutal world of Forex Trading. Also as humans we like to complicate things and we believe that if they are complicated, then we are smarter therefore it makes us feel better. Quiet often though simple things will make us a lot of money. This can be also looked at with trading strategies, keep them simple.

Mathematics doesn't aid, because markets don't move to certainties, you are only trading with odds and probabilities and that's why card players are so great at Forex trading.

Here are the reasons card players make such great Forex traders.

1. They are Patient

They wait for the right hand and only play when the odds are in their favour. Contrast this with the bulk of Forex traders who are always in the market or trying losing strategies like scalping. In Forex Trading you don't get rewarded for trading often, you get rewarded for being right.

2. The Ability to Fold

A fabulous card player will pass hands by when the betting odds are non in his favour and he is also happy to fold when in a hand, if he doesn't think he will win. He keeps his losses tight and he doesn't mind dealing them, as he knows his time will follow.

Most Forex traders on the opposite hand simply can't do this and run losses or get disappointed, as their emotions get involved.

3. Courage at the right Time

The fabulous card player knows when a great hand comes up, he needs to maximize his potential and will milk as much money from it as he can. They are prepared to bet huge amounts and hold on with discipline and win.

Contrast this with the average Forex trader who banks his profit early or bets 2% and thinks he is going to make a lot of money. In Forex trading, you need to hold and profit from long term trends and have enough riding on them to make a great profit.

4. discipline discipline discipline!

You have heard about how serious it is in Forex Trading and it is to take loss after loss as the market hurts your ego and makes you look stupid is hard. Most traders cant do - Professional card players know it's the key to success and are mentally prepared to do this and know they will hit a home run.

Keep it Simple.

Forex Trading is simple and always has been and the huge difference between winners and losers is the correct to keep losses small and bet big amounts when the time is right.

Posted by satyam at 2:46 AM 0 comments

Labels: Business, Commodities and Futures, Foreign exchange market, Forex, Forex Trading, Investing, Stock market

Forex Market - Make Money in trading

The Forex Markets do not create clear trend lines all the time. Quiet often we will experience very volatile markets and the prices can move dramatically up and down. Sometimes they can start to trend then also of sudden make a strange upward or downward movement which will trigger your stop loss and stop you out of the trade.

So How can we trade this sort of Forex Marketand make money?

1. Don't expect a long swing plan or any sustained price movements if you are already in an open position, get some profits out when you have made some from the forex market or shift it to the breakeven price as soon as possible. This will reduce the risk of losing that position.

2. When you need to trade in these conditions trade the currencies pairs that are highly correlated. So we are talking about the top 6 currencies pairs.

3. It can be also useful to use some level of Fundamental analysis such as referring to the calendar of economic announcements every now and then in forex trading. Sometimes a choppy market occurs when there is two or more economic data releasing at the same time or within a few hours. A particular news may trigger an up movement while the other one may trigger a down. Therefore it is a bad time to trade forex as you do not know exactly where the forex market is moving.

4. Sometimes when the forex trading market is choppy, it forms range-trading channels, which sets one up for a breakout. If there's is no indication on which direction the market is moving, Forex trader may go long when it's at the bottom range, and short when it is at the top range. This may earn you some pips, but again, it is better to wait for price to break out from the range-trading channels so that ideally you will be able to catch the breakout trend. This is why is why it is important to have a great forex broker too as they can help you with trading ideas. If you are looking for a Best Forex Brokerfeel free to visit the CFD FX REPORT as they have recently researched all the broker on the markets and can point you in the right direction.

The above should help you when trading choppy currency markets, but they are no guarantees of success. If you don't feel comfortable with the trade don't do it. Remember the markets are open nearly 6 days per week and 24 hours per day so there is also going to be more trading opportunities.

Posted by satyam at 2:44 AM 0 comments

Labels: Business, Foreign exchange market, Forex, Investing, Market

History

It is more than likely the oldest technical analysis tool available to Forex traders, Japanese candlesticks. Japanese Candlestick charts were developed in the 18th century by a man named Munehisa Homma. Munehisa Homma developed candlestick charts to analyze the price changes of rice contracts. He traded these contracts and was considered the best trader of his time. He became a very wealthy man for the sole use of these candlestick charts.

So what is a candlestick chart?

In simple terms the Candlestick charts is the Japanese Candlestick Charts, are simply a way to show price movement.

The charts are both very simple and powerful and when used effectively are one of the most profitable trading tools available. They are similar to line charts but much easier to read and interpret. They consist of a body, with or without a wick at each end. The body shows the opening price at one end, and the closing price at the other. The wicks show how much the price moved above or below the close. The color of the body shows whether it was an up time period, or a down period. They are brilliant and use to use you can tell by a simple look, whether the price closed higher or lower than the open. While this alone is enough to warrant using candlestick charts over line charts, this is only the tip of the iceberg in terms of the power of Japanese candlesticks.

The Chart patterns of Japanese Candlesticks

As the price of the Forex Market moves up and down, it creates distinct patterns. These patterns can tell you exactly when to enter the market and exactly when to exit the market.

When the Japanese candlesticks are combined with technical indicators these patterns work together to become very accurate. There are hundreds of patterns, the more of these patterns that you know, the better your analysis will become. Now I have only touched on the very basics of the power of Japanese candlesticks. There are many excellent books that teach these patterns in detail, after using the patterns for a while it becomes second nature.

Forex Trading with Japanese candlestick charts

Japanese candlestick charts are especially well suited to using in Forex. In Forex trading it is just as easy to make a profit whether the price is going up or down. Candlestick charts predict upturns as well as downturns. Using Japanese Candlestick Charts will not make you successful all the time. You will have wins and losses. The candlestick charts will however give you the edge you need to succeed.

Japanese candlesticks are a fun and easy way to trade forex. The candlestick charts will also help you to become successful with any strategies you are currently using. They can be an excellent aid to you when developing your own trading system. No matter what your goals are or how experienced/inexperienced you are, candlestick charts will increase your profitable trades. They will also help you avoid losing trades. Japanese candlestick charts are the easiest and most successful way to begin trading Forex.

Posted by satyam at 2:43 AM 0 comments

Labels: Business, Foreign exchange market, Forex, Forex Market, Investing, Technical analysis

Buy Sell Hold in Share Market

The "Buy" decision has two important steps: Step one allocates the available investment assets, by purpose, between Equity and Income securities, based on the goals of the investment program. It is done best using The Working Capital Model. Step two establishes strict selection quality measures and diversifies properly within each security class. Investment Grade Value Stocks are the low-risk equity champions; long-term, non-gimmick, managed CEFs produce the best income/diversification mix available in readily tradeable form.

The "Sell" decision involves setting reasonable targets for profit taking for all securities in the portfolio. Loss taking decisions must not be undertaken out of fear, and must be avoided during severe market downturns. Understanding the forces causing market value shrinkage is important and a highly disciplined hand at the emotion control button is essential. There is no such thing as a good loss of capital.

The "Hold" decision is most common, and it regulates and moderates the process, keeping it less than frantic. Continue to hold onto fundamentally strong equities and income securities that are providing their normal cash flow. Hold weaker positions until the appropriate cycle (market, interest, economy) changes direction, and then consider whether to sell or to buy more.

Posted by satyam at 2:39 AM 0 comments

Labels: Business, Investing, Investment, Stock

Stock Market Movements

Image by pitchyourbiz via Flickr

Image by pitchyourbiz via Flickr

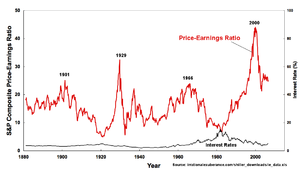

What's that? Wall Street institutions already spend billions predicting future price movements of the stock market, individual issues & indices, commodities, and hemlines. Really? Is that right also? Economists have been analyzing and charting world economies for decades, showing clearly the repetitive cyclical changes and their upward bias. Funny then, or strange would be more accurate, that the advice generated by the oracles of Wall Street seems to assume that the current environment, good or bad, will be everlasting. Isn't it this kind of thinking and advising that prolongs the downturns and "bubbles" the advances---in all markets?

If it were true that our favorite pinstriped product pushers can actually predict the future, why would investors do what they do in response to the predictions? Why would financial professionals of every shape and size holler: "sell" at lower prices, and "buy at any price" when market valuations surge upward? Shouldn't lower prices be the call to the mall? Most Wall Street soothsaying has a short-term focus that dwells upon today's market conditions; most Wall Street glossies emphasize the long-term nature of investment programs, and encourage investors to apply patience to the program they decide to use for goal achievement. Why is the advice so out of sinc?

The reason for the emphasis confusion is simple: it's easier to play to the emotion of the moment than it is to look beyond--- even though we all know that a directional change will be along eventually. Regardless of the direction, Wall Street advice will always fuel the operative emotion: greed or fear! Wall Street's retail representatives never go against the grain of the consensus opinion--- particularly the one projected to them by their superiors. You cannot obtain independent thinking from a Wall Street salesperson; it doesn't fill up the "Beemer".

Here's some global advice that you will not hear on the street of dreams: Sell into rallies. Buy on bad news. Buy slowly; sell quickly. Always sell too soon. Always buy too soon. And by the way, who do you think is buying and selling the securities you have been told to dump or to hoard?

No self respecting guru would ever refute the basic truths that the market indices, individual issue prices, the economy, and interest rates will continue to move in both directions, unpredictably, forever. Hmmm, this is where you need to focus your attention if you want to get through the investment process with your sanity. You need to expect and plan for directional changes and learn to use them to your advantage. Tranquilizers may be necessary to get you through the first few cycles, but if you have minimized your risk properly, you can actually thrive on the long-term predictability of the markets.

The risk of loss cannot be eliminated. A simple change in a security's market value is not a loss of principal just as certainly as a change in the market value of your home is not evidence of termite damage. Markets are complicated; emotions about one's assets are even more so. Cyclical changes in all markets are just as predictable conceptually as knowing approximately where you are within a cycle is knowable actually. The key is to understand what your securities are expected to do within the cyclical framework. Now there's a knowledge business with no Wall Street practitioners!

Predicting individual stock prices is a totally different ball game that requires a more powerful crystal ball and an array of semi legal and illegal relationships that are unavailable to most investors. There are just too many variables. Prediction is impossible, but probability assessment has enormous potential. Investing in individual issues has to be done differently, with rules, guidelines, and judgment. It has to be done unemotionally and rationally, monitored regularly, and analyzed with performance evaluation tools that are portfolio specific.

Posted by satyam at 2:36 AM 0 comments

Labels: Business, Investing, Investment, Stock market, Wall Street

Elements of a Trading Plan

Here are some important elements of a trading plan.

1. Why am I trading? What are my goals?

The answers to these questions might seem obvious, but they usually are not. Take some time to ask them of yourself, and seriously consider the answers. You may be surprised by what you learn. And whatever the answers, you will have a clearer picture going forward of what this enterprise means to you, and that will help you survive any rough patches.

2. What markets am I going to trade and why?

It is often best to specialize, especially for beginning stock market traders. Many pros make a great living trading the same stock day every single day for years. Choose a market that is appropriate for your experience level and trading style. Consider other factors such as available margin, volatility and liquidity.

3. What is the concept or philosophy behind your trading methodology?

Your trading system must have a concept behind it. Whether you are a value investor like Warren Buffet or a trend trader like George Soros, you should understand why you are doing what you are doing, how your beliefs about the markets define what you will do as a trader.

4. What will be your specific method?

In other words, specifically how will you execute your trading ideas? Will you buy breakouts or pullbacks? Buy oversold or sell overbought? Or will you use specific technical setups such as moving-average crossovers or another indicator-based strategy? Under exactly what conditions will you enter? When will you know to exit?

5. How much money will you risk on any single trade? On trading in general?

This is critical. Of course, start small. But just as importantly, have a plan in place for how much you will risk, emotions don't cloud your judgment when the time comes. The key is to find an allocation that doesn't cause any stress but still makes the trade worthwhile financially. One of the biggest problems with newer traders is that they are trading way too big in relation to their account size. Like when you are forex trading. Trading forex at 100-1 leverage is like introducing your mistress to your wife. Yes, you can do it, but that doesn't make it a good idea. Normally they don't get along too well.

6. What will my trading rules be?

This is also critical. Your trading rules include entry and exit rules, rules governing maximum daily, weekly or monthly losses, maximum risk on any given trade, the maximum number of trades per week, etc., etc. These rules enforce discipline and keep you out of trouble. What stock price will enter at, what stock price will I will exit. Be discplined.

7. How will I record and evaluate my trading performance?

Allow me to repeat myself: This is critical. In fact, this might be the most important element of trading for new traders in the stock market. A new stock market trader who evaluates his trades, winners and losers, in an effort to learn what works and what does not, will make quantum leaps forward in terms of ability and profitability. If you have a working trading plan and evaluate every single one of your trades after you have closed it you have already beaten 95% of the competition.

8. What are my rules for managing profits?

What's the problem with profits? Well, believe it or not there is one, and it's a serious one. It's called euphoria, and it clouds the judgment perhaps more than any other emotion related to trading. Start piling up the profits for the first time and it won't be long before you are convinced you are king of the world. About 30 seconds later you'll be broke, following a series of unwise and exceedingly risky trades. So have a plan for protecting closed profits when you have reached your goals for the week or the month. Don't give them all back.

9. How will I reward myself for following my trading plan?

Don't leave this out. Following your trading plan will bring rewards in the form of profits, but you should also consciously reward yourself for doing so because it is such an important part of successful trading. So if you finish the week or the month (or even the day) without having broken any of your trading rules, find a way to reward yourself. You deserve it. You are in rare company.

Posted by satyam at 2:33 AM 0 comments

Labels: Business, Foreign exchange market, Investing, Stock market, Trade

Successful Stock Market Trading

Image via Wikipedia

Image via Wikipedia

A stock market trading plan will not guarantee your success in the markets, but a good plan will enable you to work methodically toward your stock market trading goals while reviewing on a regular basis what is working and what is not. It will act as a roadmap for your trading journey. It will enable you to respond positively and constructively no matter what happens with your individual trades. And, most importantly, it will help you control the only thing a trader can control: his or her own actions.

Finally, stock market trading is a business. It can be a fascinating and sometimes thrilling business, but in the end it is a business. A trading plan helps you treat it as a business.

Posted by satyam at 2:30 AM 0 comments

Labels: Business, Equities, Foreign exchange market, Investing, Stock market, Stocks and Bonds, Trade

Learn To Trade Stocks

Learning to trade stocks is no easy matter. But it's not impossible. You have to set yourself out to spend some time to do research and to monitor your positions every once in a while. I have been trading stocks for over 15 years. I can remember my early years of trading. I would get into a position and then when I saw that it was going against me, I would get out, often at the very wrong time. I say that because the next day or week the stock surpassed where I had bought it from.

Learning to trade stocks requires some skill but it also requires you to shed some of your ingrained, inbred emotions. It's these very emotions that caused me to sell stocks too early in by beginning days of trading. I have overcome these emotions now and I have a set of rules that I follow religiously. That doesn't mean that I can't change the rules of my system but I have to give myself a good reason to do so. If I don't change my system than I stick to them. That is how I keep emotions out of the equation.

The most important way to help yourself when learning to trade stocks is to come up with your own system and practice. But practicing with real money can be costly. Some people refer to this as your tuition but what if you could avoid putting real money on the line and still get the practice you need?

A way to do that is by a concept known as paper trading. Now, there are critics of paper trading that state that because you are not putting real money on the line you will not have the same kinds of emotions that you would had you put your hard earned cash in. They also state that you will not get the same kind of fills that you would when you trade for real. There is some truth to these statements but it shouldn't stop you from pursuing paper trading because there are ways to reduce the aspects of paper trading that are criticized.

To counter the first item, paper trading is still experience. Yes, the emotions are not the same but what you are really doing is trying to get a feel for whether your system is working or going to work. The second item's counterpoint is if you take the midpoint of the bid and ask at any given time of the day or at the close, you would likely get filled at those levels had you traded real money. That's because it falls within the range of the bid/ask spread. I have used this technique when trading for real and with the exception of super fast moving stocks, I almost always got filled.

I think if you want to go about learning to trade stocks you need a system and you need to be able to practice trading. You want to be able to do both of these without putting up a whole lot of capital (none if you can get away with it). One system that I have found that is indispensable and reliable is the CANSLIM method.

Posted by satyam at 2:27 AM 0 comments

Labels: Equities, Investing, Stock, Stocks and Bonds, Trade

FOREX Knowledge

With the dawn of further FOREX retail traders in the market, competition amongst brokers has led to a multiplication in platform flexibility and features. Therefore, every broker over the preceding few years has tried to provide a better and easier way into the foreign exchange market in support of the beginner. I will pose various of the more obvious questions you need to find out from or ask your broker.

First and foremost are 'spreads' and how the broker deals with them. Spreads are valuable as the beginner needs to minimise his chance and reduce any expenses when entering and exiting a trade. Frequently, spreads are quoted by the broker as being 'fixed' or 'variable' for every currency pair. I have noticed that these days, spreads are continuously 'variable' and few brokers offer really fixed ones. Although they may say EUR/USD has a 3 pip spread, what they mean is so as to this is the minimum spread. You can be guaranteed that in times of high volatility, as prices are moving quickly, the spread will expand. Note furthermore, that some brokers boost their spreads if the 'lot' size is lower - see the types of account beneath. This seems a bit odd as this certainly will not promote new business for the broker!

One point to bring up is that although this point is valuable for the beginner trader, as you get extra experience, spreads turn into less of an issue while choosing a broker as they become less important and more skilled traders will point out other features over spreads when taking into account what broker to pick out. Here are lots of websites listing broker details such as http://www.etoro.iwow.us so do your homework before choosing!

The next entity is whether the broker offers all three of the 'standard' accounts - regular, mini and micro. Regular accounts deal with full 'lots' ($10 loss or profit for each pip movement in the currency, if trading a USD pair) and therefore require the principal amount of opening capital of around $5000. Although mini accounts ($1 loss or gain for each pip movement) are now abundant and ordinary, they still require a certain amount of capital to open so as to may be further than some new traders. Micro accounts (Only 10c loss or gain for each pip movement) deal with such small sums of money that they are better than trading demo, but the chance is low when it comes to losing capital. Consequently, they require the smallest amount start-up capital in the region of only a couple of hundred dollars.

Various checks will be made when you open an account, and if the company is based in another country, you will need to fill in various tax exemption forms such as a W-8BEN previous to the account will be opened, don't let this put you off!

A further check you could wish to do previous to considering a broker is to check their performance at the Commodity Futures Trading Commission website www.cftc.gov to ensure they are listed and have the vital minimum turnover and liquidity. Any sizable court cases will also be listed.

If you expect to carry out 'position' or 'swing' trades, such that you will be holding overnight positions, you might want to check what rates of interest will be paid/debited from your account. This is now and again hard to find on some websites, but can be very informative as generally brokers offer poor 'carry' interest if you are in a trade for a lenghty period of time.

Check to ensure what currency pairs they offer - again, generally companies offer most of the most commonly traded pairs but it's nice to see how 'established' they are by seeing if they offer other trades such as gold, S&P, futures etc.

Unfortunately, something you can't check is the kind of service the broker offers. Mainly will be 'discount' brokers, which basically means that they offer no trade advice or all-purpose help and if you address to anybody on the trading floor about your trade, they will be usually be brief and 'to the point'.

Try to find a broker who has downloadable free software that you trade from on your computer. The other way is to trade 'live' from a website, but I discover this inflexible, especially if you constantly need to click between screens as this usually requires the loading of a new webpage and makes everything quite 'clunky' even if you maintain a fast broadband connection.

Posted by satyam at 2:22 AM 0 comments

Labels: Business, Currency pair, Foreign exchange market, Forex, Investing, Money, Trade

How To Start Investing

Image by Getty Images via Daylife

Image by Getty Images via Daylife

For the newbie investor just knowing the name of the investment or company you're putting your money in is just the beginning. There are often a lot of minor but important details that you must learn about before you decide to invest. If you had the time and know how you could analyze financial statements, speak with company employees and the company suppliers and so on and so forth. However not many of us have the time necessary to put towards being a full time investor.

Just because you may not have the time to be a full time investor shouldn't scare you away from investing. You can still find quality companies to invest in and it doesn't have to take a lot of your time. The first thing you need to do is get quality information and then you can make purchases of quality investments, you can then leave the management of your investments to individuals who are qualified to manage them.

Having someone else manage your investments will allow you to do the things your good at and leave you with more free time to do the things you like to do. One of the most important parts of investing is knowing what you can do for yourself and knowing what you should hire an expert to do. For example, if you're considering investing in stock in the overseas market then it might make more sense to invest in a mutual fund. Overseas markets can be trickier to navigate than domestic markets, especially for a beginner, so a mutual fund manager would likely be the best place to turn. This would be easier than putting all of your time, energy and money into trying to pick foreign stocks on your own.

The best way to build your wealth would be to invest in businesses which make you an owner, be it a partial owner or a full owner. These types are investments are not always for the faint of heart due to the up and down nature these sorts of investments can have. Investments where you would become at least a part owner include stocks, some form of a small business or real estate vehicles.

Posted by satyam at 2:19 AM 0 comments

Labels: Business, Investing, Investment, Money, Small business, Stock

Debt Consolidation Loan

Image by Getty Images via Daylife

Image by Getty Images via Daylife

It’s very easy to use those charge cards you were saving “for an emergency” and very quickly it can spiral out of control. If you also have student loans, car loans or other types of bills, it all just adds up. If you need to consolidate debt, you are not alone. Those late fees and interest charges add up and it can be very overwhelming.

How a Debt Consolidation Loan can help you ?

A debt consolidation loan basically takes all of your bills, such as those from credit card companies, household bills etc. Then, they are all consolidated into one monthly payment which is lower than the sum of payments on individual debts. Then, as long as you are able to make this one monthly payment, your credit will remain in good standing and you will be working toward the goal to get your bills paid off.

Debt Consolidation Program - An option to Avoid Bankruptcy

Many people feel pushed up against a wall and may think their only option is bankruptcy and they later regret the effect it has on their credit. Debt consolidation can save you from this. A debt consolidation program can help you manage your money troubles and it’s typically as easy as a simple phone call.

A debt consolidation program will help you pay off all your debts and stop the creditors from harassing you. In addition, you will also have the benefit of fewer interest and late charges from each individual creditor since they will all be combined. Free debt consolidation information can be obtained from the internet and from companies that provide debt consolidation loans.

How we can help you Consolidate Debt ?

Apart from getting a solution to your debt and credit problems, you can also seek budget and financial counseling to help you manage better in the future. There are debt consolidation companies designed to help you ease your financial worries. So, if you want to stop over complicating life by having to make multiple payments each month, why not unravel the financial confusion and apply now for a debt consolidation loan.

Posted by satyam at 2:14 AM 0 comments

Labels: Bankruptcy, Credit card, Debt consolidation, Mortgage, Personal Finance

UNDERSTANDING PRICE TRENDS

Image via Wikipedia

Image via Wikipedia

In the stock markets, prices are fixed by the interaction between buyers and sellers. The price of a share at any given moment of time depends upon the relative pressures exerted by the buyers and sellers of that particular share on one another. The balance or point of equilibrium reached between these two opposing pressures is the price at which actual transactions take place. Price, thus, represents the point of agreement reached between buyers and sellers.

Price movements are caused by variations in the strength of buying and selling pressures. If the buying pressure increases, the equilibrium is upset and the share price moves up to a higher level where a new balance is struck between buyers and sellers. The price of a share at any given point thus represents only a temporary equilibrium between buying and selling pressures.

Posted by satyam at 9:37 AM 0 comments

Labels: Business and Economy, Canada, Financial Services, Price, Share price, Stock, Stock market, United States

PERFORMANCE OF INVESTMENT EXLPERTS

All investment experts have one thing in common: they are all veritable storehouses of information and knowledge on the economy and the corporate world. However, not all of them have the required analytical abilities, foresight or wisdom to use this information to make the right investment decision at the right time. As a result, it would be difficult to find an investment expert who does not make at least a few major blunders every year. Even great thinker and visionaries have been known to lose their reputations in the stock markets. John Maynard Keynes, the towering economic genius whose ideas gave birth to the IMF , the World Bank and the concept of deficit financing, failed to anticipate or understand the greatest stock market crash in history. He mistook the collapse of the U.S. stock market in 1992 for a “bull point for world prosperity”. However, despite this spectacular and widely-publicised blunder, he had an enviable and consistently successful record as a stock market investor. He not only made himself a fortune of several million dollars, but also deployed the fund of his college in the stock market and multiplied them ten times over. If Keynes could make a blunder, then no investment analyst can possibly hope to be infallible.

Posted by satyam at 9:35 AM 0 comments

Labels: Business, Economic, Investment, John Maynard Keynes, Stock market, Stock market crash, United States, World Bank

A LOSER’S GAME

Investing in the stock markets is not a winner’s game, but a loser’s game. There is a big conceptual difference between these two types of games. In a winner’s game, the game is won by the winning actions of the winner. In a loser’s game, the game is lost by the losing actions of the loser. In the latter, the game is won by the player who makes the fewest mistakes, whereas in the former, it is won by the player who makes the maximum number of right decisions. In a loser’s game, the final outcome is determined by the number of wrong decisions, and not by the number of right decisions, that each player makes. Losers’ games have another important characteristic. The winner does not win, but the loser defeats himself by making mistake after mistake.

Investing in the stock markets is not a winner’s game, but a loser’s game. There is a big conceptual difference between these two types of games. In a winner’s game, the game is won by the winning actions of the winner. In a loser’s game, the game is lost by the losing actions of the loser. In the latter, the game is won by the player who makes the fewest mistakes, whereas in the former, it is won by the player who makes the maximum number of right decisions. In a loser’s game, the final outcome is determined by the number of wrong decisions, and not by the number of right decisions, that each player makes. Losers’ games have another important characteristic. The winner does not win, but the loser defeats himself by making mistake after mistake.

How and why is stock market investing a loser’s game? In the stock markets, your chances of success depend upon the errors of others. All buying and selling opportunities arise out of the over-reactions of the majority of the other players who constitute the market. If they do not consistently and systematically make errors of judgement, you would not get an opportunities become available only when other players make mistakes- the bigger and more common the mistakes, the greater the opportunity to make big profits.

Posted by satyam at 9:31 AM 0 comments

Labels: Business, Equities, Guides, Investing, Research and Analysis, Stock market, Stocks and Bonds, Win–loss record

Tips For Day Trading

Image via Wikipedia

Image via Wikipedia

Day trading the stock market involves the rapid buying and selling of stocks on a day-to-day basis. This technique is used to secure quick profits from the constant changes in stock values, minute to minute, second to second. It is rare that a day trader will remain in a trade over the course of a night into the next day. These trades are entered and exited in a matter of minutes.

The main question that most people ask when it comes to day trading is simple: Is it necessary to sit at a computer watching the markets ALL day long in order to be a successful day trader?

The answer is no. It's not necessary to sit at a computer all day long. There are a number of factors to consider, but generally the rule of day trading is to trade when everyone else is trading. In other words, trade in the morning.

As with all financial investments, day trading is risky in fact, it's one of the riskiest forms of trading out there. The stock prices rise or fall according to the behavior of the market, which is entirely unpredictable. Day traders buy and sell shares rapidly in the hopes of gaining profits within the minutes and seconds they own those particular stocks. Simple to do in theory, harder to do in practice.

If you are constrained by a small amount of capital, you may not be able to buy large amounts of a stock, but buying only a small amount can add to the risk of a loss. And, obviously, it is impossible to predict with certainty which stocks will result in profits and which in losses. Even the best of traders must learn to accept both outcomes.

It's also important to know that in day trading, it is the number of shares rather than the value of shares that should be the focus. If you day trade, you WILL face losses, but even for the more expensive stocks, the loss should be marginal, because prices do not usually fluctuate to an extreme degree over the course of just one day.

The day trading industry deals in a large variety of stocks and shares. Here are just a few:

Growth-Buying Shares: shares made from profit, which continue to grow in value. Eventually, these shares will begin to decline in price, and an experienced trader can usually predict the future of this type of share.

Small Caps: shares of companies which are on the rise and show no signs of stopping. Although these shares are generally cheap, they are a very risky investment for day traders. You'll be safer to go with large caps and/or mid-caps, which are much more secure and stable thanks to a premium.

Unloved Stocks: company stock that has not performed well in the past. Traders buy these shares in the hopes of generating profits if and when the stock rises in value. As with small caps, unloved stocks can be a risky choice for day traders.

These examples are NOT your only options when it comes to day trading stocks. The best way to determine which type of stock is right for you is to invest some time for careful research, a knowledge of market patterns, a solid strategy, and a disciplined trading plan.

You need to learn to trade ONLY when the market gives the right signals, and ONLY when the volume of activity in the market supports a successful trading opportunity.

Posted by satyam at 9:28 AM 0 comments

Labels: Business, Day trading, invest, Investment, Option, Stock, Stock market, Trade

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=58c17385-e1b8-4441-8c01-05c474d59008)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=c6726a12-82ca-4642-943e-7cf386d08bc4)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=6cce65af-d2dd-4d3a-b117-3a557d2bc133)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=85693566-b56d-4635-95ee-a1c977c9b102)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=7f655c47-b075-4e6d-aa2a-c18fb167f33f)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=df211a87-1503-45ed-85e2-d193adc8959a)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=5b346b06-e31a-40ad-af6b-253323ea1b2c)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=d848cff3-a6d8-4b6d-9e69-7ffbd6ee8a25)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=3366f048-6406-4c79-8697-28524bdb9bb6)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=8f2c56d5-8601-46d6-bb8f-1ddb7cd37116)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=f5ed5594-e0f5-4387-a5a2-5731782f535d)